We use cookies to help you navigate efficiently and perform certain functions. You will find detailed information about all cookies under each consent category below.

The cookies that are categorised as "Necessary" are stored on your browser as they are essential for enabling the basic functionalities of the site. ...

Necessary cookies are required to enable the basic features of this site, such as providing secure log-in or adjusting your consent preferences. These cookies do not store any personally identifiable data.

Functional cookies help perform certain functionalities like sharing the content of the website on social media platforms, collecting feedback, and other third-party features.

Analytical cookies are used to understand how visitors interact with the website. These cookies help provide information on metrics such as the number of visitors, bounce rate, traffic source, etc.

Performance cookies are used to understand and analyse the key performance indexes of the website which helps in delivering a better user experience for the visitors.

Advertisement cookies are used to provide visitors with customised advertisements based on the pages you visited previously and to analyse the effectiveness of the ad campaigns.

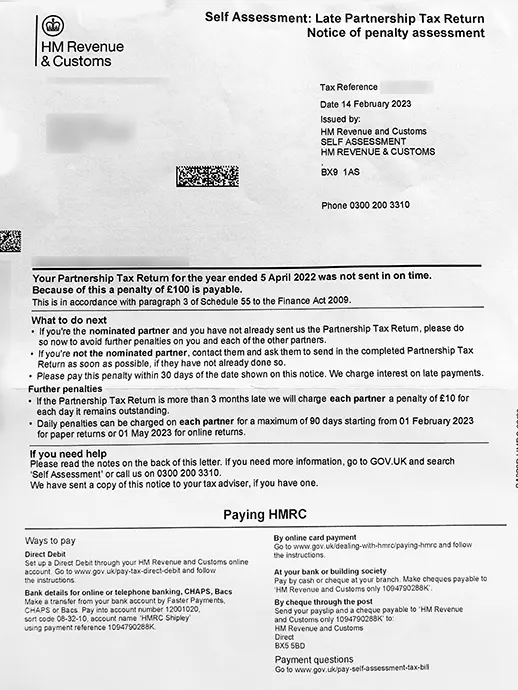

It's a notice by HMRC informing the partners of a partnership firm about the late filing penalties that have been attracted due to late-filing / non-filing of partnership tax return timely.

Partnership tax return shows the incomes received and expenses incurred on behalf of partnership firm, which is different to the individual partner's return. Each partner needs to submit his own return separately.

On failure to meet the deadline, each partner who was a member of the partnership during the return period is charged £100. If the return is more than 3 months late, each partner is charged a penalty of £10 for each additional day of delay, for a maximum of 90 days. If the return is more than 6 months late, each partner is charged a penalty of £300 and if more than 12 months late, a further £300 penalty is also attracted.

Since the return is running late, immediately file the partnership tax return to avoid any further rise in penalties to be levied on the partnership as well as partner. Also, the levied penalty needs to be paid timely to avoid any interest charges. The payment can be made by following modes