Every business has its ups and downs. There are times you are crashing the charts and next thing you know that you are struggling to survive or there might be times when your revenues soar up but the expenses rise at double the speed, leaving you with some negative numbers in hand. The only ‘not-so-gloomy’ part of such time is that you are eligible to use these negative figures to bring down your tax bills of current and future years (or even a previous year, maybe!) when paying corporation tax. A quick guide to cut down your tax bill in start times;

We stated tips to reduce a corporation tax bill in our blog a little while ago. In this article, we shall focus specifically on how trading losses can be used to reduce CT payments. Hence, it becomes imperative to build up an understanding of what Trading losses are.

Trading losses

In an accounting year, when the amount of total allowable business expenses exceeds the taxable income, then the gap between these two figures is called the trading loss.

You need to take these factors into consideration to find out your trading loss:

- Capital allowances

- Balancing charges

- Certain annuities and charitable donations

Loss on sale or disposal of property should not be omitted while calculating trading loss.

If you have enough trading losses which remain even after setting off with the current year profits then you may choose to carry it back to an earlier accounting period or carry it forward to be set off against the profit for future periods.

Claiming trading loss in the current period

As discussed above, trading loss needs to be the first set off against total profits in the same accounting period in which they occur.

In the current year corporation tax return, follow the instructions to allow the set off:

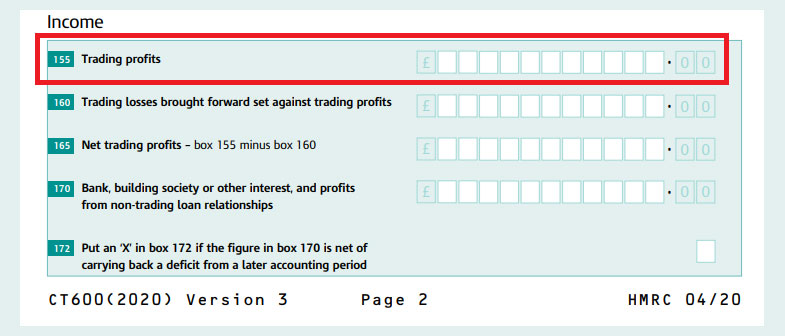

1. Enter ‘0’ in box 155 on form CT600.

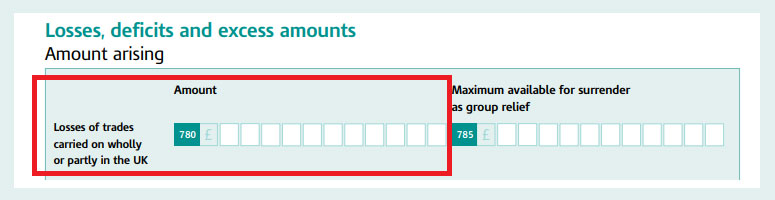

2. Onto the box 780, but the full amount of the loss.

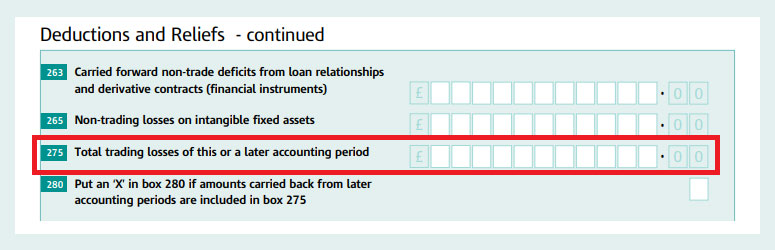

3. Enter the whole loss or as much of the loss as you can claim, in box 275 against your total profits.

Carry forward of trading losses

You can carry forward the amount of trading loss incurred minus the portion utilised in the current year when the loss was incurred as well as any portion of the trading loss surrendered as group relief. Please note that Group relief has been talked about in the latter part of the article). For the sake of brevity,

Amount of trading loss to be carried forward = Total loss incurred – Amount set off against current year profits – Amount surrendered as group relief.

Let’s take up different situations to understand how to carry forward trading losses work.

Situation 1: If the accounting period ends before 1 April 2017

You can only use the carried forward a trading loss relief against profits of the same trade.

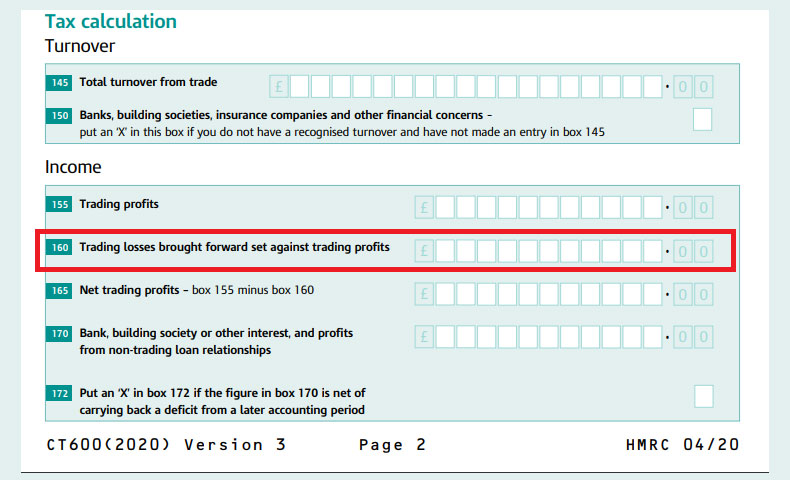

To offset such brought forward losses you need to check these in box 160 on your Company Tax return.

Situation 2: If the accounting period starts before and ends after 1 April 2017

There are special rules to carry forward losses in such cases. Click here to find out more.

Situation 3: If the accounting period starts on or after 1 April 2017

Under this situation there can be 2 scenarios:

- The company made a loss BEFORE 1 April 2017

Such carry forward loss can only be used against profits of the same trade in which loss was incurred. - The company made a loss on or AFTER 1 April 2017

Such carry forward loss can normally be used against your company’s total profits.

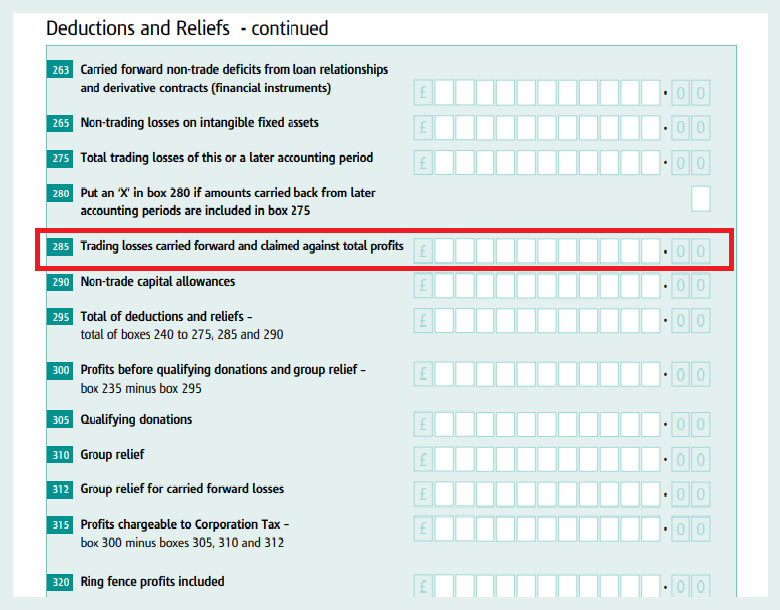

To offset such brought forward losses you need to put these in box 285 on your Company Tax return. (CT600)

You can decide the amount of such brought forward loss you wish to use to offset the company’s profits. Alternatively, you can choose to use none of these in this period by putting a 0 (zero).

It should be kept in mind that there are restrictions on the amount of carried forward losses that can be offset against profits of accounting periods from 1 April 2017. These are as follows:

- If the carried forward losses that arose before 1 April 2017 are used to offset against current year losses then the maximum amount of relief that can be claimed shall be restricted to the amount of an allowance up to £5 million, plus 50% of remaining trading profits after deduction of the allowance.

- Overall cap: The maximum amount that can be used to offset profits by utilising carried-forward losses (including carried-forward trading losses incurred before 1 April 2017) is limited to the amount of an allowance up to £5 million, plus 50% of remaining total profits after deduction of the allowance.

Carry back of trading losses

The law allows you to carry back the loss that arose in the current period, to be offset against profits of the previous 12 month period. But that’s not as straightforward as it sounds. The clincher here is you can do this only if your company was into the same trade/business at some point in the accounting period or periods that fall in the earlier 12 month period.

Another important parameter here is that if your accounting period straddles the 12 month period, the profit for that period will be apportioned and the loss will only be allowed to set off against that particular portion of the profit that falls within the 12 month period.

The carryback of trading losses can be made in any of the following ways:

- In Company Tax Return for the period in which the loss was made.

- In an amendment to the return, as long as it is made within the time limit to amend

- By posting a letter regarding the same.

If you prefer to offset a loss against an accounting period for which you’ve already paid the corporation tax due, then HMRC will send you a repayment. However, if you owe any Corporation Tax to HMRC, then it will be deducted from the payment first.

Group Relief for trading losses

If your company is a part of a qualifying group with other companies, then you may choose to offset certain losses, including trading losses against the profits of other members of the group, instead of carrying it forward or back. Also, if your company has carried forward trading losses made on or after 1 April 2017 (Situation 3.b), other companies in the group may be able to use those losses to offset their profits.

Points to remember:

- There’s no limit on the number of years the trading losses can be carried forward.

- When the loss relief is to be claimed, the loss of an earlier accounting period needs to be relieved before the losses of later accounting periods.

- Loss from business carried on with the aim of making profits can only be claimed. So losses for a hobby won’t be allowed as a loss relief.

- If in the loss-making period the company traded wholly outside the UK, then no loss relief can be claimed for such loss incurred.n

- The claim for loss should be made within 2 years from the end of the accounting period when the loss was made.

- When a loss is made, the company should use that loss to first set it off against the current year’s profits, only then can the balance loss be carried back.

Further reading: HOW TO REDUCE CORPORATION TAX BILL