What are National Insurance contributions?

National insurance contributions refer to money paid into the government coffers to qualify for certain state benefits like maternity allowance, jobseeker’s allowance, and the State Pension.

Who is required to pay National Insurance?

Anyone who is 16 years old or more in age and either:

- an employee, earning above £183 a week

- a self-employed, making a profit of £6,475 or more in a year.

What are the pre-requisites for making national insurance contributions?

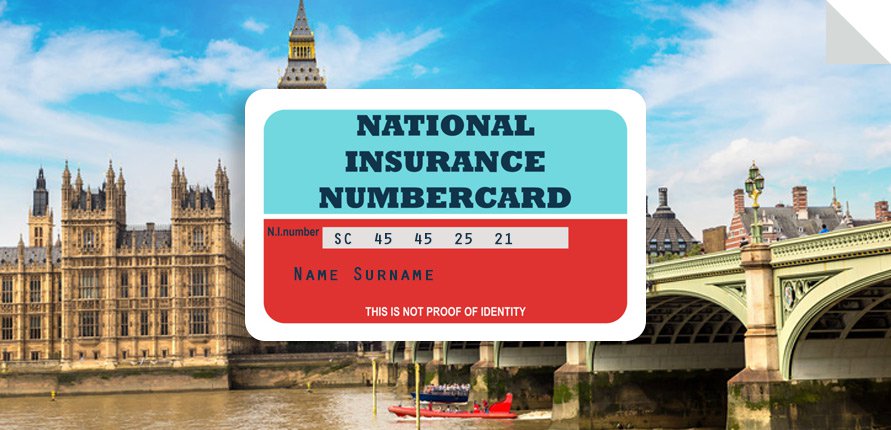

Before starting to pay for national insurance contributions one needs to have a National Insurance number. The national insurance number helps to identify the taxpayer and ensures that the amount paid by the taxpayer as a national insurance contribution is accurately recognised.

What is the National Insurance number and how can I get one?

NI number is a combination of letters and numbers comprising of two prefix letters, six digits, and one suffix letter for example AB123456N. This number helps in matching the contributions made against the name of the person. Further, this number also acts as a reference id when a person needs to contact the Department of Work and Pension and HMRC with regard to national insurance.

If you plan to work, claim benefits, apply for a student loan or make voluntary national insurance contributions, you need to apply for a NI number. For applying you need to be based in the UK and have permission to work or study in the country. To apply for NI number Click here

How to find a National insurance number if I have lost it?

If someone loses the national insurance number then it could be found on some official papers like on P60, payslips, the national insurance section of self-assessment tax return, or on other letters for official correspondence. If you still struggle, you can fill a CA5403 form and send it to the address stated on it or contact the national insurance helpline.

What are the various national insurance classes?

There are five national insurance classes. They are:

| National insurance class | Who pays | Condition for paying |

|---|---|---|

| Class 1 national insurance | Employee & Employer | An employee earning more than £183 a week and are under State pension age. |

| Class 1A or 1B | Employer | On employee’s expenses or benefits provided by the employer |

| Class 2 national insurance | Self-employed | Required to pay if he/she earns more than £6,475 a year |

| Class 3 national insurance | Voluntary contributors | These are paid to fill or avoid gaps in National Insurance record |

| Class 4 national insurance | Self-employed | If he/she earns profits over £9,501 a year |

How much National Insurance Contributions need to be made?

National insurance contribution rates are reviewed every year in the annual budget.

The national insurance contribution rates for the tax year 2020-21 are:

| National insurance class | NIC rates prescribed |

|---|---|

| Class 1 national insurance | Employee pays If the income is between £183 to £962 a week (£792 to £4,167 a month) then 12% If income is Over £962 a week (£4,167 a month) then 2% Employer pays 13.8% on all earnings above secondary threshold i.e. £169 for almost all employees |

| Class 1A or 1B | 13.8% |

| Class 2 national insurance | £3.05 a week |

| Class 3 national insurance | £15.30 a week |

| Class 4 national insurance | 9% if profits are between £9,501 and £50,000 2% on profits of over £50,000 |

Let’s take a closer look into different classes in detail:

A comprehensive view of point no. 6 & 7 could help in understanding the various classes in a better way:

a) Self-employed NI contributions

Class 2 NIC: The self-employed, earning more than £6,475 a year is required to pay NIC at the rate of £3.05 per week that makes it up to £158.6 for the tax year 2020-21.

Class 4 NIC: The sole traders, earning more than £9,500 up to £50,000 will be required to pay NIC at the rate of 9% of its profit.

This drives us to an important conclusion that, sole traders earning more than £8,632 will have to pay both Class 2 NIC as well as Class 4 NIC.

b) Employee NI Contributions(other than a director)

If the employee earns between £183 to £962 a week (£792 to £4,167 a month) then NI contributions shall be made at the rate of 12% of earnings. It should be noted here that the contributions are based on what taxpayers earn in the current period. If the amount paid in the current period exceeds the threshold, then the employee will be liable to make NI contributions even if the pay for the next period goes below the threshold.

The employer shall deduct such contribution from the employee’s salary/wage while processing payroll and the contribution will get reflected on their payslip.

c) Director NI contributions

Directors are also classified as employees and so they too are required to make national insurance contributions when their annual salary and bonuses exceed £9,500. For the director’s the period under consideration is a complete year, unlike employees where each period is considered separately irrespective of other periods in that year.

It is noteworthy that NICs for directors is calculated on annual earnings but they are required to be paid to HMRC each time the usual payroll is run (whether weekly, monthly, or quarterly).

d) Employer NI Contribution

If the employee earns above the national insurance secondary threshold (£169 for the year 2020- 21), then the employer will also have to make an NI contribution at the rate of 13.8%.

e) Voluntary NI Contributions

Voluntary contributions are generally made to fill gaps in a person’s national insurance contribution record to qualify for benefits like the State Pension. One should keep in mind that all the voluntary contributions do not always increase the payer’s state benefits. It is advisable to contact the Future Pension Centre to ensure if the person will be benefitted from voluntary national insurance contributions or not. Click here to contact Future Pension Centre.

Conclusion

NI contributions are sort of today’s savings for the sake of a comfortable future. Hence it becomes important to understand its relevance today so that the correct contribution can be made. So if you still have a question or need help feel free to contact us at 020 3960 5080 or write to us at info@debitam.com.