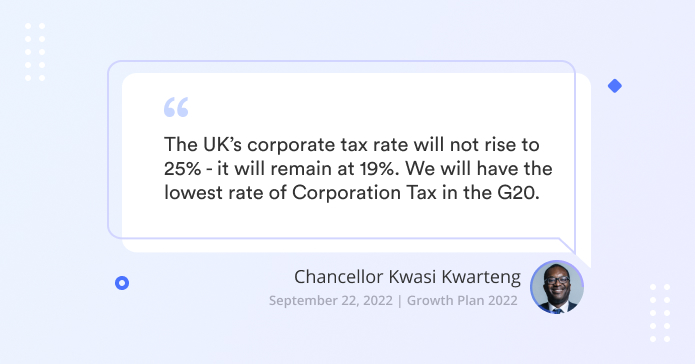

On October 14, 2022, Truss sacked Mr Kwarteng and appointed Jeremy Hunt as the new Chancellor. Also made a U-Turn from Corporation Tax Relief and reintroduced the increased rate of 25% starting this upcoming April.

How much corporation tax will increase over a year?

In April 2023, the UK government plans to increase the rate of corporation tax from 19% to 25%. This will affect businesses of all sizes and is expected to raise an additional £6.2 billion in tax revenue each year. The move has been criticised by some as a 'tax on success, but the government argues that it is necessary to help reduce the deficit. Corporation tax is a key part of the government's tax revenue, and the increase is likely to have a significant impact on businesses across the country.

Corporation tax is a charge that is levied on profits made by companies and other organisations in the UK. The current corporation tax rate is 19%, but this is set to increase to 25% in April 2023. This will be the first time the rate has increased since 2010 when it was lowered from 28% in an effort to stimulate economic growth.

Small Businesses Will Be Affected by the Rise

Businesses of all sizes will be affected by the tax increase, but small businesses may find it especially difficult to cope with the additional costs. Many small businesses operate on tight margins and cannot easily absorb unexpected expenses. The corporation tax rate increase could force some small businesses to close their doors for good. You can find out some helpful tips to reduce your corporation tax bill here.

The government has said that the corporation tax increase is necessary to help reduce the deficit. However, critics argue that it is a 'tax on success' and will damage the economy. Only time will tell how the corporation tax increase will affect businesses in the UK.

How Can Your Business Survive after the Tax Raise?

If you are a business owner, it is important to speak to an accountant about the impact the corporation tax rate increase will have on your business. Debitam can help you with all your corporation tax needs. We can help you to prepare your accounts and file your corporation tax return. We can also offer advice on how to minimise your corporation tax bill. Contact us today to speak to one of our experts.