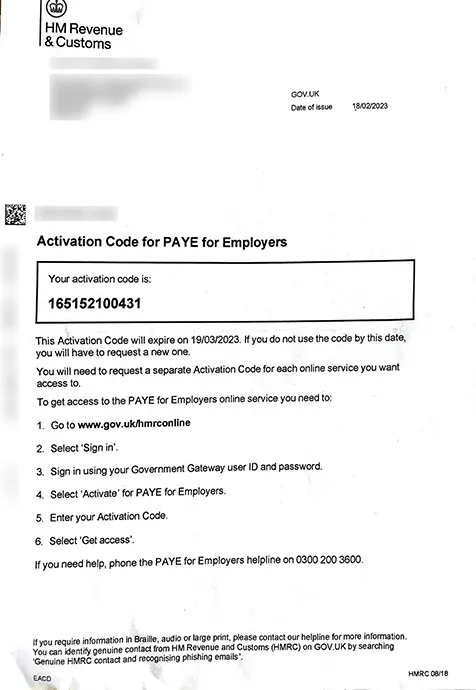

It is a letter from HMRC containing activation code for PAYE online services. The code contained therein should be used within 28 days from the date of its issue.

PAYE activation code is a 12-digit code that is needed to activate your company's PAYE account as an employer.

As soon as you create an online account, you need to activate services for each kind of tax service separately using its activation code, which you get in the post from HMRC. Once you successfully enroll for the PAYE tax online services, you will receive this letter containing the activation code within 7 days of enrolment.

To activate the PAYE online service, you must login to your online account and enter this code when prompted. You’ll then be given access to the tax service and it will be added to your HMRC online services account. In case you haven’t requested the same, get in touch with your trusted accountant to know the further steps.

You must sign into HMRC online services and enroll for the service again. You can also contact your accountant, who would do this on your behalf.

Nothing to worry about, get in touch with your accountant or authorised agent, who might have requested the same on your behalf.