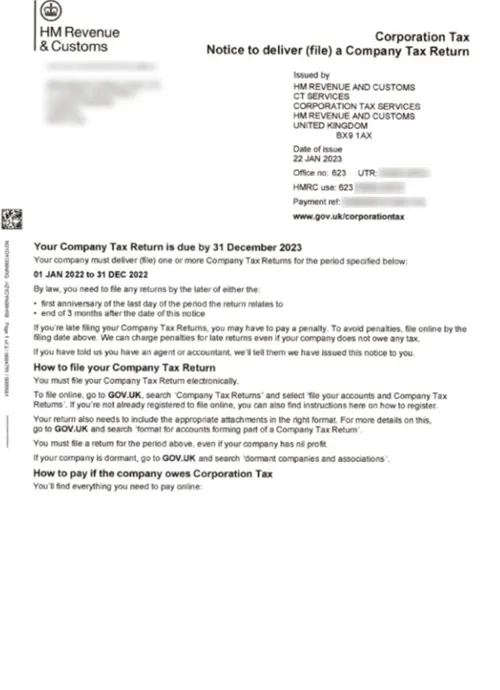

It is a reminder notice from HMRC to file a corporation tax return (CT600) in order to avoid potential rise in penalties and escape disciplinary actions.

It's a record of incomes earned, expenses incurred, allowances, reliefs and most importantly the tax figures payable to HMRC.

All companies, whether dormant or active, reporting profits or losses, needs to action on such a notice.

You get 12 months to file tax return from the end of company's accounting period. So each company's deadline would be different, unlike self-assessment return where there is a fixed deadline of 31 January.

A one day delay from deadline would attract penalty of £100, another £100 would be accumulated if the delay is made up to 3 months. Any further details would add up a percentage of corporation tax bills to the total penalties. Note: Three consecutive delayed returns would make penalties rise by a 5 times multiplier.