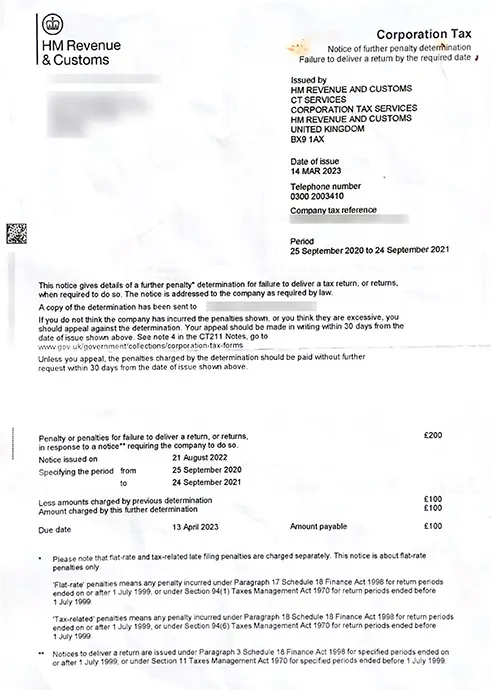

This notice gives details of any further penalties levied by HMRC, for failure to deliver a tax return, after a notice has already been issued by HMRC.

The penalties stated in the notice are due and needs to be paid in full within 30 days of the issue date mentioned on the letter.

In cases where you feel that the penalties are excessive or should not be levied, you can appeal the penalties within 30 days of the issue date on the letter, in writing stating reasons, along with stating the reference and the period.

If you've received a determination you must act now and deliver the returns to avoid further penalties. Penalties for late returns start at a flat rate of £100 and can increase to £1,000 plus tax-related penalties of up to 20% of any unpaid tax.

When delivering a return, the following things need to be delivered to HMRC including -