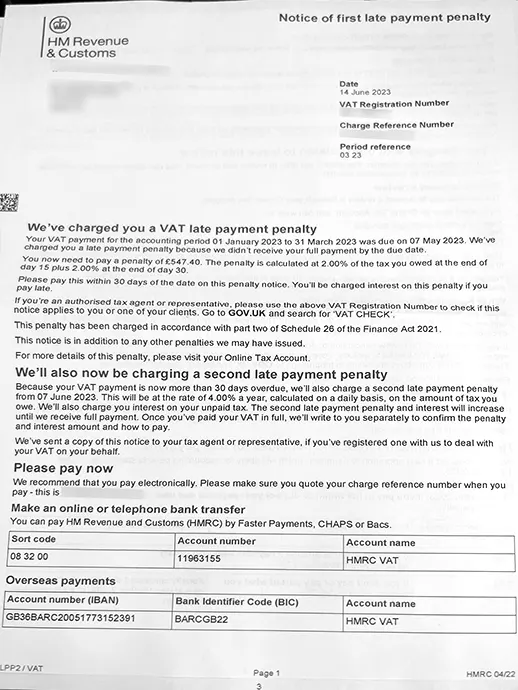

This is a penalty charge notice from HMRC on account of late VAT liability payment. The correspondence is more of an informative nature and needs to be actioned within 30 days to avoid further delays.

Since VAT periods and schemes differ across businesses, you should check your VAT return submission and payment deadline in your HMRC online account. As a general rule, the due date to submit VAT returns and pay is the 7th day of the second month following the reporting period.

The penalty is calculated at 2% of the tax you owed at the end of day 15plus 2% at the end of day 30.

Once the payment gets overdue for more than 30 days, post 30 days a second penalty is levied at 4% a year, calculated on daily basis of the amount you owe.

Similar to first charge, interest is charged on the unpaid amount until the entire liability is settled.

HMRC usually prefers payments to be made electronically for quick and hassle free transfers. A payment reference number would be given in the letter so received under ‘please pay now’ section. The beneficiary bank details of HMRC are also mentioned in the correspondence being made for easy reference.