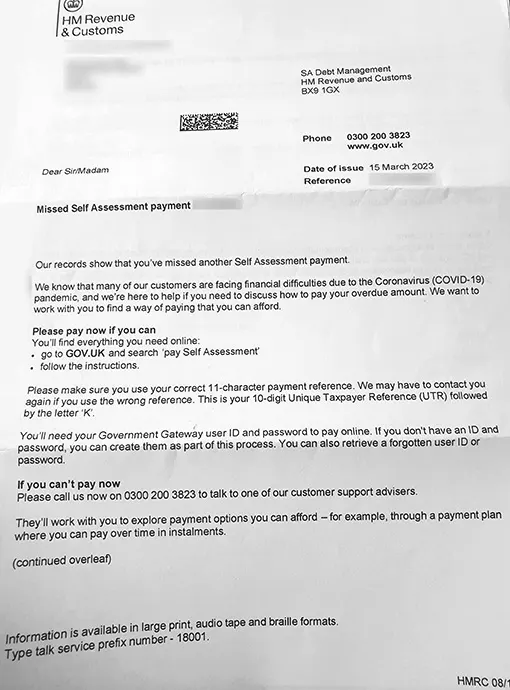

This is a reminder notice from HMRC that your self-assessment taxes are overdue and they could even extend a helping hand in situations of financial distress.

HMRC keeps on charging late payment penalties as well as interest, so make sure that you pay all liabilities at the earliest. Payments can be made through following modes

The time lags between original payment and its receipt with HMRC differs in case of different modes. Make sure the payment reaches HMRC timely.

Use your 11 digit payment reference number (which is 10 digit UTR followed by the letter ‘K’)

HMRC has been very supportive in such circumstances & could draw a plan to overcome them. A flexible option to pay your taxes in installments over time or any other for that matter, which you can afford, can be agreed with HMRC by contacting them and letting them know about the issues faced.

HMRC gives an opportunity to review & convey why you think their decision is wrong or send any new information which has not been considered earlier. They also offer extra support in case of health related difficulties.