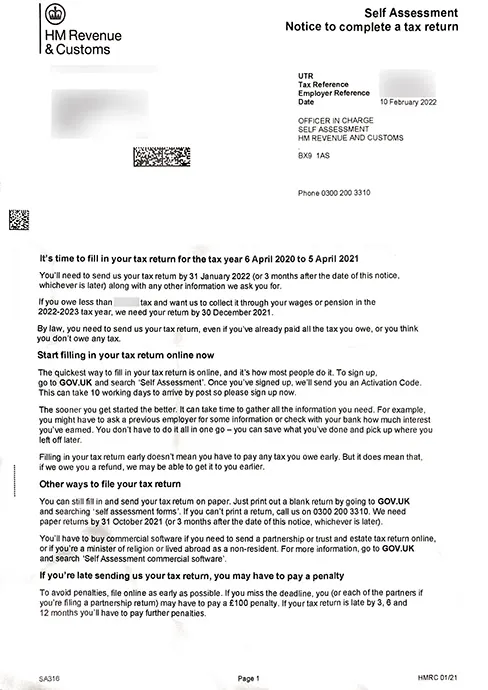

It is a reminder notice from HMRC to file a self-assessment tax return in order to avoid penalties and escape disciplinary actions.

Self-Assessment is the process by which you inform HM Revenue & Customs (HMRC) about your income, gains and relevant expenses for a tax year which HM Revenue & Customs (HMRC) uses to collect Income Tax.

We will need to send a tax return if, for the last tax year (6 April 2022 to 5 April 2023), you were self-employed as a sole trader and earned more than £1,000, a partner in a business partnership or on earning income more than a threshold. Check at https://www.gov.uk/check-if-you-need-tax-return to ensure if you need to submit a return.

You need to action this letter with an online return by

Whichever is later. Paper tax returns need to be sent by 31 October. We need to action on this letter even if we think that all the taxes have been paid, or we don’t owe any tax.