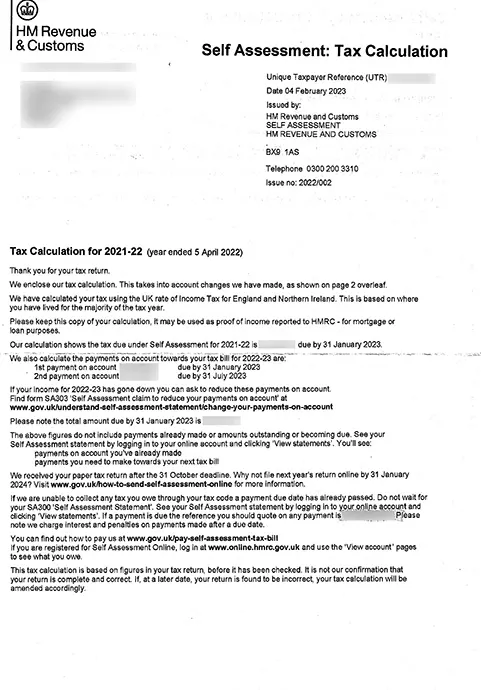

This is HRMC’s correspondence to inform you about the changes that they have made to the return which the taxpayer has filed on the records. It contains their calculations and the reason why they’ve amended it.

This letter revises your tax return to replace the figures calculated by HMRC over your self-assessment. It can be used as a proof of income reported to HMRC. Also, the liabilities mentioned on the letter are the revised liabilities that need to be paid for the mentioned tax year.

After reading the reasons mentioned on this letter if you still feel that the amendment made by HMRC to your calculation is not appropriate, you can inform HMRC in writing but within 30 days of issue date of this notice about your disagreement. This way they’d change the figures back to the original return that was earlier filed.

This amendment doesn’t affect your right to amend your tax return which can still be amended. The time limit to amend remains the same i.e., 12 months from the deadline to file self-assessment tax return for the corresponding tax year.

No, this letter should not be considered as HMRC’s confirmation of all figures on your return. Basically, these are some obvious errors and missed incomes on your tax return. They can still scrutinise this return and amend the tax return accordingly.