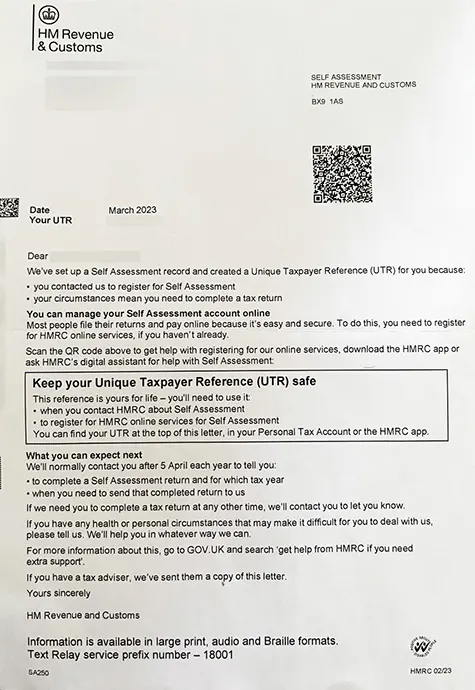

The letter contains a code which identifies an individual or business entity and is used by HMRC on all dealings with his/her tax. The person’s tax records are all available with HMRC and can be tracked with the help of UTR.

It is a 10 digit code unique to all taxpayers in UK. It is required for all correspondence made with HMRC. It facilitates HMRC to process tax returns in an effective, efficient and accurate manner. It helps to identify the person (i.e., whether it’s a company, partnership, etc.), so that their records can be managed accordingly. It might just be called ‘tax reference’. In instances, UTR will have a K at the end, used by HMRC to identify individual taxpayers.

No, both the UTRs are separate. The one contained in this particular letter helps to recognise data in your personal capacity as an individual, and not company. Since HMRC uses a separate UTR for both matters, for identification purposes, whenever they're dealing with tax situation, it's important to make sure that both of them are kept handy and separate.

We get a UTR number once we register for self-assessment automatically. It can also be requested later, if you cannot find one. It can also be the case that your agent/ accountant have requested this with HMRC on your behalf.

It is mentioned on self-assessment returns, HMRC notices, HMRC Statements, online tax account and in the letter received just after registration. If you can’t find it, you can get in touch with HMRC to request it through post.